Insured losses from weather events in Canada last year top $3 billion

Canada's damaging weather in 2023 took a pricey toll on insurance companies, with claims exceeding $3 billion for a second year in a row

Another year of destructive weather events in Canada meant another hefty bill for insurance companies.

According to Catastrophe Indices and Quantification Inc. (CatIQ), more than $3 billion was accrued in insured damages for a second consecutive year. Across the country, the insured loss for severe weather events exceeded $3.1 billion.

DON'T MISS: From fires to floods: Canada's 2023 was a fury of record-breaking weather

In a recent news release, the Insurance Bureau of Canada (IBC) referred to 2023 as the fourth-worst year for insured losses in the country.

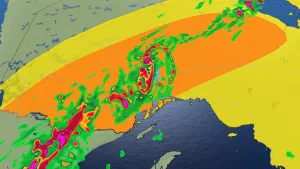

The year was renowned mostly for a record-breaking 12 months of wildfires, but was also highlighted by the amount of flooding that caused destruction in a good portion of Canada, especially in Nova Scotia.

Despite the number of blazes in the provinces and territories, IBC indicated there were no changes in the affordability or availability of wildfire protection coverage across Canada.

But, due to rising losses and adjusted risk modelling, Canada is seen as a "riskier place" to insure, according to IBC. Many in the country are unable to access flood insurance. As well, the process to acquire insurance for earthquakes and related hazards are becoming more difficult for some Canadian households.

Nova Scotia flooding in July 2023. (Nathan Coleman/The Weather Network)

“The federal government committed to a national flood insurance program in last year’s federal budget. However, progress has stalled, leaving too many Canadians vulnerable to the effects of our changing climate,” said Craig Stewart, vice-president of climate change and federal issues for IBC, in the news release.

“Once launched, this program would provide Canadians living in high-risk areas with affordable financial protection and peace of mind when a flood strikes. Details of the program must be shared with our industry and the provinces this winter if it’s to be operational before the next federal election.”

Costliest 2023 events

Feb. 3–5: Atlantic Canada cold snap – $120 million

April 5–6: Ontario and Quebec spring storm – $330 million

May 28–June 4: Tantallon, N.S., wildfire – $165 million

June 18–July 26: Prairies summer storms – $300 million

Hail in Sunderland, Ont., in August 2023. (Lisa Marie Fletcher/Facebook/Submitted)

July 20–Aug. 25: Ontario severe summer storms – $340 million

July 23: Nova Scotia flooding – $170 million

Aug. 13–Sept. 16: Behchokǫ̀-Yellowknife and Hay River, N.W.T., wildfires - $60 million

Aug. 15–Sept. 25: Okanagan and Shuswap, B.C., area wildfires – $720 million

Aug. 24: Winnipeg, Man., hailstorm – $140 million

“The increasing frequency and severity of climate-related disasters should be of concern to all Canadians, even if they have yet to be directly affected,” Stewart added.

McDougall Creek wildfire in B.C., August 2023. (Randy/Submitted)

Also noted by IBC was the increasing frequency of high-cost losses every year in Canada. Insured, catastrophic losses in the country regularly top $2 billion annually, most of which is water-related damage.

The company said there have been more than 35 catastrophic flooding events in over the last 10 years in Canada, resulting in insured losses of more than $30 million per event. The total of insured losses from the events have averaged close to $800 million a year over the last decade, IBC added.

WATCH: Summer 2023 was a season of records and astonishing sights

Thumbnail courtesy of Carrie Ryan/X, taken in South Shore, N.S.

Follow Nathan Howes on the X platform, formerly known as Twitter.